New Developments (in brief)

With the Regulation Amending the Regulation on Program of Compliance with Obligations of Anti-Money Laundering and Combating the Financing of Terrorism published in the Official Gazette, dated 22 August 2025 and numbered 32994, significant amendments have been made to the Regulation on Program of Compliance with Obligations of Anti-Money Laundering and Combating the Financing of Terrorism (“Compliance Program Regulation”). You can access the relevant official gazette here and the Compliance Program Regulation here.

What changes do the amendments bring?

The amendments to the Compliance Program Regulation are listed below:

- Development and investment banks have become obliged parties under the Compliance Program Regulation

Before the recent amendment, except for the Central Bank of the Republic of Türkiye and development and investment banks, banks were stipulated as obliged parties under the Compliance Program Regulation pursuant to subparagraph (a) of paragraph 1 of Article 4 of the Compliance Program Regulation.

With the recent amendment, development and investment banks have been removed from the exemption and the İstanbul Settlement and Custody Bank (İstanbul Takas ve Saklama Bankası A.Ş.) was added to the list of institutions exempted from the obligation. Thus, development and investment banks are now included in the scope of the Compliance Program Regulation. Accordingly, development and investment banks are required to appoint a compliance officer and a deputy compliance officer by 31 October 2025 and establish a compliance program by 30 November 2025.

- The requirements for those to be appointed as compliance officers have been expanded

The amendments to paragraph 2 of Article 17 of the Compliance Program Regulation which sets out the qualifications required for those to be appointed as compliance officers, a new condition has been introduced. Accordingly, individuals to be appointed as compliance officers must not have conducted any examinations or audits within the two years preceding the date of appointment on the obliged party to which they will be appointed.

- New regulations have been introduced regarding the notification to MASAK related to the resignation of the compliance officer and the deputy compliance officer

Pursuant to Article 20 of the Compliance Program Regulation, prior to the amendment, if it was determined that the compliance officer and the deputy compliance officer lacked the required qualifications or resigned from their duties, obliged parties were required to notify MASAK of these circumstances. With the amendment, the dismissal of the compliance officer and deputy compliance officer was added to the situations subject to notification.

Within this scope, when a compliance officer or a deputy compliance officer resigns or is dismissed, obliged parties are now required to explicitly state the reasons for such dismissal or resignation in their notifications to MASAK within 10 days from the relevant date.

- The scope of the obliged parties required to appoint an exclusive compliance officer has been changed

Pursuant to Article 29 of the Compliance Program Regulation, the appointment of a compliance officer at the administrative level without establishing a compliance program constitutes an exclusive compliance officer appointment.

In parallel with the amendment made in subparagraph (a) of paragraph 1 of Article 4 of the Compliance Program Regulation explained above, the expression “development and investment banks” in Article 29 of the Compliance Program Regulation, which determines the obliged parties that are required to appoint an exclusive compliance officer, has been replaced with “İstanbul Settlement and Custody Bank (İstanbul Takas ve Saklama Bankası A.Ş.).” Thus, development and investment banks have been included among the obliged parties required to appoint an exclusive compliance officer, while Istanbul Settlement and Custody Bank has been exempted from this obligation.

In addition, the obliged parties required to appoint an exclusive compliance officer under the Compliance Program Regulation have been expanded to include dealers who engage in games of chance and betting exclusively in an electronic environment without a physical workplace and without face-to-face interaction with customers in accordance with their relevant legislation. The compliance officer to be appointed within this scope must be appointed by 31 October 2025.

- The requirements for those to be appointed as the exclusive compliance officer have been expanded

With the amendment to Article 30 of the Compliance Program Regulation, which governs the requirements for those to be appointed as exclusive compliance officers, the condition of “graduating from higher education institutions in Türkiye (or abroad whose equivalency is recognized by the Higher Education Quality Council) that provide at least four years of education” has been added to the eligibility criteria for exclusive compliance officer appointments.

- An alternative to the newly introduced requirement to be appointed exclusive compliance officer is provided

With Transitional Provision 5 added to the Compliance Program Regulation, those who have been working as an exclusive compliance officer for at least six months as of 25 December 2025 and who do not meet the requirement of “graduating from higher education institutions in Türkiye (or abroad whose equivalency is recognized by the Higher Education Quality Council) that provide at least four years of education” will be given the opportunity to take the authorization exam for two years as of 25 December 2025, provided that their work is certified by the social security institution’s records. It is regulated that such persons will be granted a Compliance Officer License if they are successful in the authorization exam, and thus, they may be appointed as a compliance officer or assistant compliance officer even if they do not meet the education requirements described herein.

Conclusion

With the amendments dated 22 August 2025, comprehensive changes were introduced to the Compliance Program Regulation. In line with these amendments, it is critical for existing obliged parties to review their operations in accordance with the new regulations and implement the necessary changes by the specified deadlines. Likewise, institutions that have newly become obliged parties must fully comply with the obligations outlined by the relevant dates.

We would like to reiterate that as a general rule in the event of a violation of the obligations set out in the Compliance Program Regulation, a written warning will be given to the obliged parties, and a period of not less than 30 days will be given to remedy the violation. If the deficiencies are not remedied at the end of this period, an administrative fine of TRY 3,777,903 will be imposed on the obliged parties for the violation occurred in 2025. Alongside notification of the administrative fine, a new period of not less than 60 days will be given with a written warning. If the deficiencies are not remedied at the end of this period, an administrative fine of TRY 7,555,806 will be imposed for the violation occurred in 2025. If the deficiencies are not rectified within 30 days following the notification of the second administrative fine, the situation will be notified to the relevant institution in order to take measures to suspend or restrict the activities of the obliged parties for a certain period of time or to revoke its operating license. Likewise, additional sanctions may also be applicable depending on the specific circumstances. In addition, pursuant to the third paragraph of Article 13 of Law No. 5549, one-quarter of the administrative fine will be imposed on the responsible member of the board of directors or the senior manager, provided that the warnings specified in the second paragraph are made and the deadlines are complied with. These administrative fines are subject to revaluation every year.

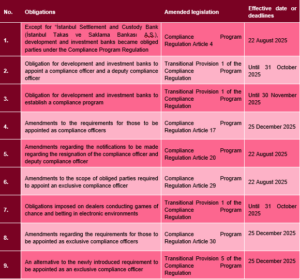

The table below shows the amendments and the effective dates of the relevant amendments: