New Developments (in brief)

Draft Financial Crimes Investigation Board General Communiqué (Serial No. 30) (“Draft Communiqué”), published on MASAK’s website on 1 August 2025, outlines measures regarding increasing transparency, preventing unregistered transactions and strengthening the security of the financial system in EFT, remittance and cash transactions conducted through financial institutions as a draft. In this regard, the Draft Communiqué is designed to reinforce compliance with the standards of the Financial Action Task Force (FATF) and align with both national and international obligations. You can access the Draft Communiqué here.

The Draft Communiqué is planned to enter into force on 1 January 2026.

What changes do the amendments bring?

Key developments introduced by the Draft Communiqué

In alignment with FATF recommendations, the Draft Communiqué outlines the principles and procedures regarding the enhanced measures to be implemented by obliged parties within the scope of know-your-customer obligations. Accordingly, Article 4 of the Draft Communiqué sets forth the following enhanced measures:

- Obligations to monitor, obtain and retain information on cash transactions have been introduced

Financial institutions are required to closely monitor their customers’ cash transactions, pay special attention to unusually large and frequent cash transactions that do not have an apparent reasonable legal and economic purpose or are inconsistent with the customer profile, take the necessary measures to obtain sufficient information about the nature of the transaction requested, and keep the information, supporting documentation and records obtained from the customer for eight years, ensuring that they are available to the relevant authorities upon request.

Paragraph 13 of Article 4 of the Draft Communiqué defines the term “nature of the transaction” as the business or transactions from which the money and precious metal are obtained in cash deposit transactions; the purpose of the transaction in cash withdrawal, electronic transfer and money order transactions; and both the business or transactions from which the money and precious metal are obtained and the purpose of the transaction in electronic transfers and money orders made as cash transactions.

- New criteria for the declaration of the nature of the transaction in electronic transfers and remittances have been introduced

Banks, payment institutions and electronic money institutions are allowed to offer their customers the most frequently used transaction types as options for declaring the nature of the transaction for electronic transfers and remittances. However, except for the subjects determined by the Central Bank of the Republic of Türkiye for electronic transfers, and remittances the options should include, at a minimum, real estate purchase payment, motor vehicle purchase payment, lending/debt payment, gift/donation/charity, tax/duty/fee, compensation/insurance payment, lawyer/consultancy/advisory payment, health payment, crypto/digital asset, games of chance/betting payment and entertainment/social media payment. If customers select options that do not provide concrete information about the nature of the transaction among the options offered, a transaction description that is at least 20 characters long must be obtained regarding the nature of the transaction.

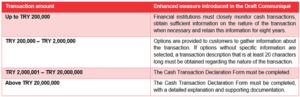

- New criteria for the disclosure of the nature of the transaction in cash transactions have been introduced

Financial institutions are allowed to offer their customers the most frequently used transaction types as options for disclosing the nature of cash transactions, provided that the transaction amount or the total amount of multiple related transactions falls within the range of TRY 200,000 to TRY 2,000,000 (inclusive of these amounts). If options that do not contain concrete information about the nature of the transaction are selected among these options, a transaction description that is at least 20 characters long must be obtained regarding the nature of the transaction.

- An obligation to complete a form for cash transactions above a certain amount has been introduced

Financial institutions are obliged to ensure that the cash transaction declaration form provided in Annex-1 of the Draft Communiqué (“Cash Transaction Declaration Form”) is completed for the declaration of the nature of the cash transactions, where the transaction amount or the total amount of multiple related transactions ranges between TRY 2,000,001 and TRY 20,000,000 (inclusive of these amounts). If options that do not contain concrete information regarding the nature of the transaction are selected in the Cash Transaction Declaration Form, a transaction description that is at least 20 characters long must be obtained regarding the nature of the transaction.

Financial institutions are obliged to ensure that the Cash Transaction Declaration Form is completed for cash transactions where the transaction amount or the total amount of multiple related transactions exceeds TRY 20,000,000, by including a detailed explanation and adding the relevant supporting documentation.

For transactions that require the Cash Transaction Declaration Form to be completed, consent from the customer or the individual making the transaction on their behalf may be obtained through a signature on the transaction receipt or via internet/mobile banking, SMS OTP, digital link or telephone banking, provided that all information in the Cash Transaction Declaration Form is included. However, if it is not possible to obtain documents regarding the nature of the transaction due to its specific nature, the customer or their representative must still complete the Cash Transaction Declaration Form and include a description that is at least 50 characters long explaining the nature of the transaction.

- The cases where an automatic registration system is permitted have been determined

For electronic transfers, remittances of a known nature and cash transactions, financial institutions may generate an automatic record instead of obtaining a customer declaration. Examples of these situations include invoice and credit card debt payment.

- The conditions under which transactions cannot be performed are regulated

If customers fail to declare the nature of their transaction and complete the Cash Transaction Declaration Form for the electronic transfers and remittances mentioned above, the obligated parties must refrain from executing the requested transaction.

- Regulations regarding the implementation of the measures together with other obligations have been determined

The measures described in Article 4 of the Draft Communiqué do not prevent financial institutions from implementing additional actions related to electronic transfers, remittances and cash transactions or from requesting information, explanations and documentation about the nature of any transaction, regardless of the amount, if there are grounds for suspecting that a transaction requires reporting.

- Exceptions in the implementation of the enhanced measures have been determined

The enhanced measures described in the Draft Communiqué are not required to be applied to the following transactions:

a) Transactions between a customer’s accounts within the same financial institution

b) Transactions where the customer is a public institution or organization

c) Transactions between banks where the customer is the bank

d) Transactions performed within the scope of correspondent banking

e) Electronic transfers and remittances made from ATMs and the transaction amount or the total amount of multiple related transactions does not exceed TRY 15,000

f) Cash transactions made from ATMs and the transaction amount or the total amount of multiple related transactions does not exceed TRY 200,000

- The basis of calculation of transactions to be made in foreign currency has been determined

It is regulated that the monetary amount of transactions in foreign currency should be calculated based on either the Central Bank of the Republic of Türkiye’s indicative foreign exchange buying rate announced for the relevant day or the exchange rate for informational purposes not subject to trading.

Penalty for noncompliance with the enhanced measures introduced by the Draft Communiqué

If the obligations introduced by the Draft Communiqué are not complied with, the first and second paragraph of Article 13 of Law No. 5549 on Prevention of Laundering Proceeds of Crime (“Law No. 5549”) will be applicable.

Pursuant to the first paragraph of Law No. 5549, an administrative fine of TRY 60,000 is imposed for financial institutions per violation. This amount is subject to revaluation every year. To provide an idea, if the relevant regulation were in effect as of now, the administrative fine per violation would be TRY 453,342 for violations occurred in 2025. Since the relevant regulation is expected to take effect on 1 January 2026, the relevant administrative fine will be recalculated based on a revaluation of TRY 453,342.

For the sake of completeness, non-compliance with the rules set out in the Draft Communique, in cases resulting in a breach or suspected breach of another regulatory framework, may entail the imposition of different sanctions for violation of the relevant regulation, in addition to the fines provided for herein.

Conclusion

MASAK intends to implement enhanced measures that will significantly impact the operations of financial institutions.

As these enhanced measures are planned to take effect on 1 January 2026, it would be beneficial for financial institutions to make the necessary preparations in the coming months, taking this timeline into account, and closely monitor the upcoming developments related to Draft Communiqué.

You can review the actions to be taken regarding the monetary thresholds introduced by the Draft Communiqué in the table below: