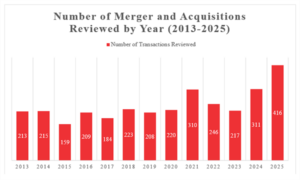

On 7 January 2025, the Turkish Competition Authority (“TCA”) published on its website the M&A Overview Report for 2025 (“Report“), accessible here in Turkish. As a practice that has been in place for 13 years, the TCA publishes these reports every year to provide statistical information on the concentrations that come under the TCA’s radar through merger/acquisition applications. As before, the report allows us to better understand the TCA’s concentration supervision workload and related macro trends.

Some important data included in the Report are as follows:

- Number of Merger and Acquisition Files: In 2025, the Competition Board (“Board“) reviewed and decided on a total of 416 files. Compared to the year 2024, there has been approximately 34% increase in the number of merger and acquisition application files that have been resolved. At the same time, the record high caseload of 311 files in 2024 was exceeded by more than one hundred files in 2025.

- Geographical Scope: The target company of 162 concentrations reviewed by the Board in 2025 was established in Türkiye.[1] There was an approx. 24% increase in the number of such transactions from 131 in 2024. On the other hand, the number of resolved merger control filings on concentrations realized abroad by foreign undertakings increased by approx. 38% in 2025 compared to 2024, from 164[2] to 226. In other words, as in 2024, more than half of the files examined by the Board in 2025 consisted of transactions not involving a company established in Türkiye.

- Leading Sectors: According to the Report, the leading sectors (by number of transactions) in terms of the Turkish Transactions examined by the Board (i.e., transactions of which the target is established under the laws of the Republic of Türkiye) have not changed much compared to 2024. Accordingly, in 2025, the sectors in which highest number of Turkish Transactions were realized in as follows: (i) “computer programming, consulting and related activities” (25 transactions) and (ii) “generation, transmission and distribution of electrical energy” (10 transactions).[3] In 2025, the highest transaction value among Turkish Transactions concerned the field of “monetary intermediation”; in 2024, it was in the “retail trade conducted outside of stores, stalls, and markets” field.

- Privatizations: In 2025, the Board reviewed 19 privatizations related to “generation, transmission and distribution of electrical energy”, “wholesale of household goods”, and sub-sectors of “manufacture of wiring and wiring devices”.

- Commitments and Phase II reviews: The Board initiated Phase II review regarding two concentrations in 2025.

- The Review Period: In the Report, the average number of calendar days for the TCA to decide on an application from the “last notification date” is stated as 10. It was reported as 12 calendar days in 2024 by the TCA. For completeness, the term “last notification date” refers to the date on which the responses to the additional information and document requests sent by the TCA are completed. In other words, although this data provides an estimate of the time taken by the TCA to review a completed/complete application, it does not take into account the time required to complete the responses to the information requests that the TCA often directs to the parties to the transaction and/or third party market players in merger control proceedings in order to complete an application, and therefore does not provide an indication of the total time elapsed between the original first notification date of a transaction and the Board’s decision.

In conclusion, the Report summarizes the TCA’s merger control activity in 2025 and provides certain statistical information. This data can be used to understand the Board’s workload and to make deduction regarding review periods, as well as to make comparisons with previous years and to interpret how macroeconomic developments have affected concentration supervision in Türkiye.

[1] All parties involved in 93 of these transactions are of Turkish origin.

[2] No information is available regarding the transaction value for the three transactions concerned.

[3] In 2024, 23 Turkish Transactions were realized in the sector of computer programming, consulting and related activities, and 13 in the sector of generation, transmission and distribution of electrical energy.